Submitted by cyberentomology t3_y7efgs in dataisbeautiful

Comments

cyberentomology OP t1_isuhc5b wrote

“It’s OK if we’re losing money, we’ll just make it up on volume”

cyberentomology OP t1_isugz5b wrote

It’s still more profitable than retail…

wheslley_eurich t1_isuh91u wrote

Yes but historically aviation companies have a very short life compared to another industries

cyberentomology OP t1_isycb5d wrote

It’s not only utterly brutal on cash flow, it’s also extremely capital intensive. Which is why a few people with access to large amounts of capital (like Udvar-Hazy, and GE) made themselves incredibly wealthy by allowing airlines to convert those massive capex into much more manageable opex.

There is a saying is that “if it flies, floats, or f🤬ks, it’s a lot cheaper to rent it”. This applies to the airline industry in a big way.

cyberentomology OP t1_isu2crk wrote

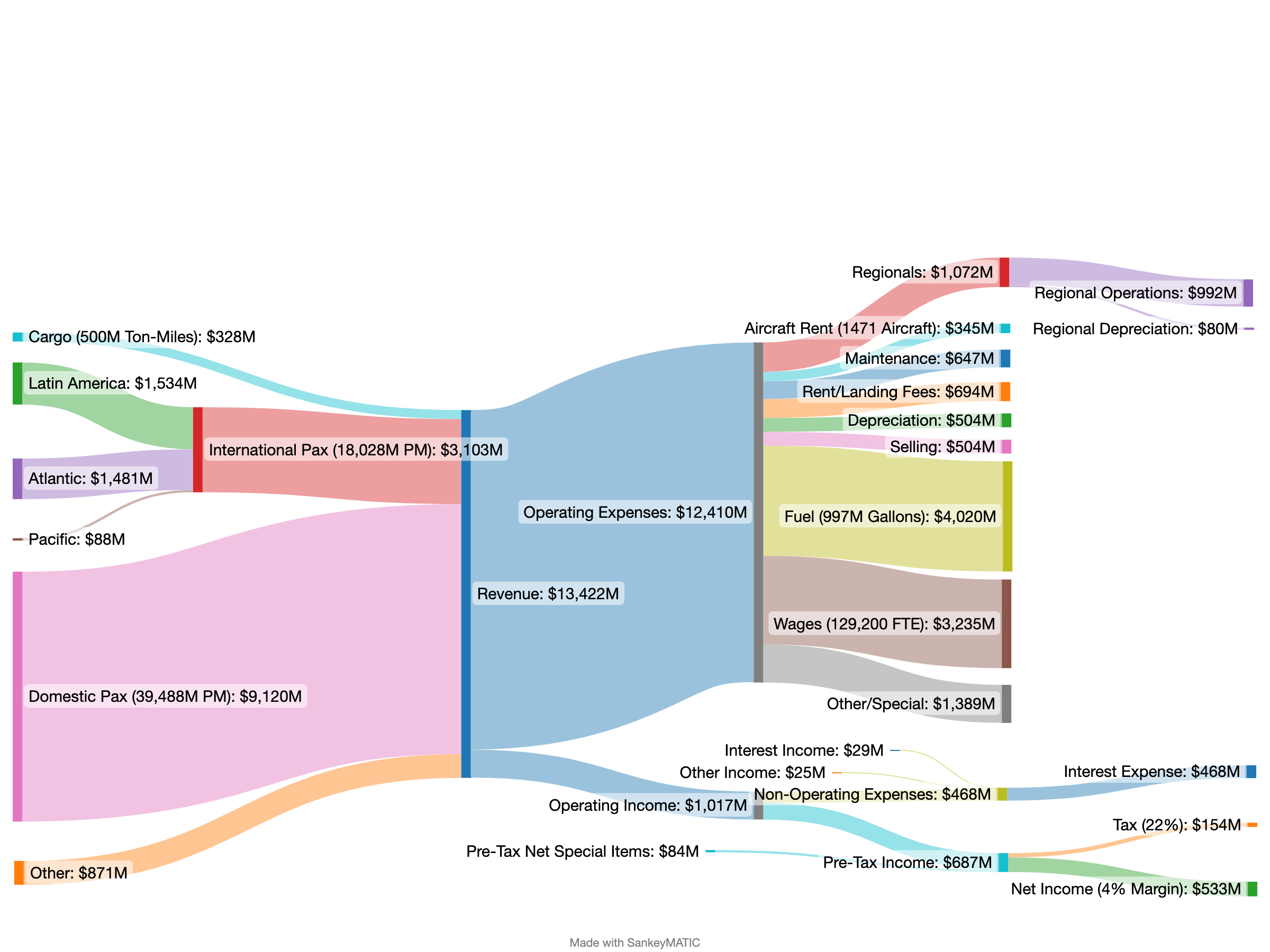

Data Source: AAL 22Q2 Financial Results (July 21, 2022)

Tool: SankeyMatic

Some Interesting Observations:

- They're getting jet fuel for only 4 bucks a gallon... Hell of a deal.

- Fleet-wide, they're averaging about 58 passenger miles per gallon. That's pretty damned efficient...

- Average annual (loaded) payroll per FTE is about $100K.

- Revenue is about 18 cents per passenger-mile. They keep less than 1 cent of that.

- No dividends, they've got a few billion in debt to pay down.

- Taxes! The government is making more money on the airline than the airline is making on the airline.

- $154M in federal income tax

- $210M in federal payroll tax

- $250M in federal excise tax on jet fuel (24.4 cents/gallon) -- this is largely what funds the FAA

- State Taxes on jet fuel are unknown but state jet fuel tax per gallon in their US hubs:

- Texas (DFW) 20 cents

- Illinois (ORD): 1.1 cents

- California (LAX): 2.0 cents

- North Carolina (CLT): none (tiny inspection fee only)

- Pennsylvania (PHL): 1.2 cents

- DC (DCA): 23.5 cents

- New York (LGA): 6.5 cents

Q3 results are due out any day now.

tuctrohs t1_isv0o9s wrote

It's interesting that they spend more on fuel than any other expense. And much more than on aircraft. That means that companies making more efficient aircraft should be able to sell them easily.

Note that the government's tax revenue isn't profit. They need to run the FAA among other things. Comparing that to profit is like calling the airline's revenue profit, and you illustrate that those numbers are vastly different.

cyberentomology OP t1_isve0fg wrote

Yeah, a 5% efficiency gain from a new aircraft is huge and absolutely worth retiring old (and paid for) hardware.

cyberentomology OP t1_isve44m wrote

No such thing as profit to the government. They don’t produce anything, they only consume. Rent seeking at its finest. At least the airline gets something in return for it.

CoachKoranGodwin t1_isxr1yi wrote

This is a great post, in part because it very clearly shows how such a crucial aspect of our economy is deeply tied to the price of fuel.

The airline industry is in trouble. Fuel costs will likely continue to rise and American demographics point towards a continued increase in the price of labor.

cyberentomology OP t1_isxseyp wrote

United just posted Q3, I’ll put that one up here in a bit.

cyberentomology OP t1_isy8jlh wrote

Worth checking out the post I just put up for Delta. They're able to get their fuel for $3.53/gallon, as they actually own a refinery. They also have payroll and employee profit sharing that is 60% higher than AA.

857477457 t1_isue3w0 wrote

Darn, never really realized that they basically have no Pacufuc flights. Guess they can't compete with Asian carriers?

skyecolin22 t1_isvflyj wrote

Pacific countries have opened up much more slowly than other countries post-covid, so there's far fewer flights west than there were in 2019.

cyberentomology OP t1_isy7km2 wrote

AA releases their Q3 results tomorrow (October 20), will have an update.

wheslley_eurich t1_isufduu wrote

I remembered that saying about aviation. Q: you know how turn into a millionaire in the aviation industry? A: being a billionaire. All this money on the table but the profit is so low.