Submitted by rosetechnology t3_zatq5f in dataisbeautiful

Comments

[deleted] t1_iyomtcu wrote

[deleted]

millhouse-DXB t1_iyo5jth wrote

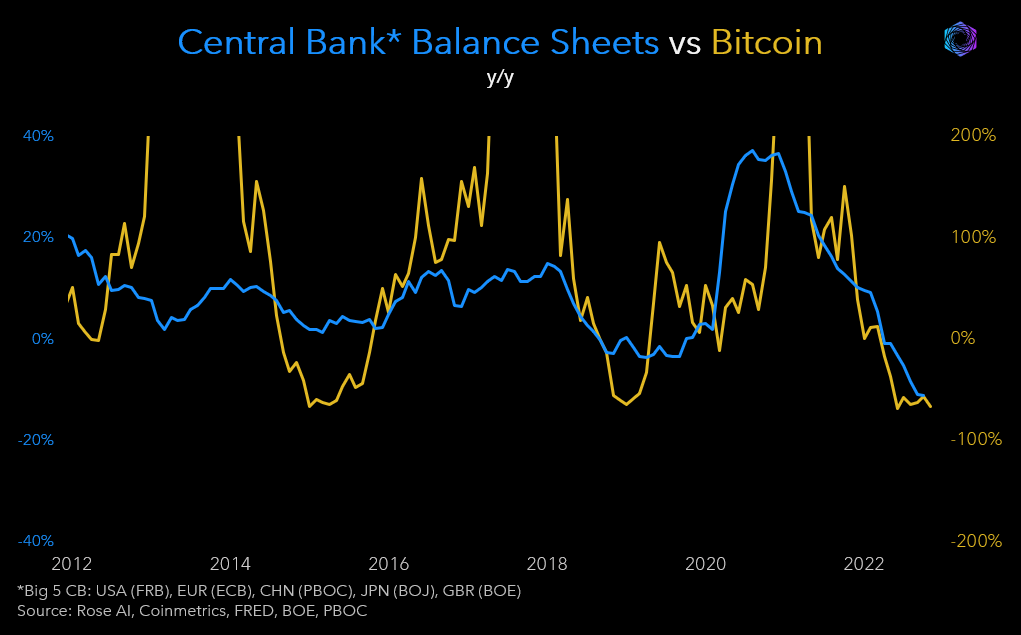

Thank you for confirming my suspicion that they are not correlated.

BadSanna t1_iynlxrl wrote

Sooooo completely unrelated?

Aqueilas t1_iynyrkw wrote

What are you trying to show? Seems like no correlation

Wizard01475 t1_iyp82wa wrote

Not much of a correlation

[deleted] t1_iynin3u wrote

[removed]

[deleted] t1_iynl4nl wrote

[removed]

[deleted] t1_iyogff5 wrote

[deleted]

backwardog t1_iyoidw9 wrote

That is indeed what the plot shows.

Guavifo t1_iynj7xh wrote

Nice relationship! Is this statistically significant?

phdoofus t1_iynkoho wrote

You can't really tell because you don't know what data is the driver. They've agglomerated the balance sheets of five central banks in to one and you don't know what the percentages mean or what's driving them, neither do you know what's driving the bitcoin price, which could be completely different.

Alternative-Look8413 t1_iynkwrj wrote

Idk if any relationship between pretend money and real money is statistically significant but the "conventional wisdom" would be an inverse correlation.

Old_Gringo t1_iynm1qd wrote

So? I assume you've adjusted the Y axis to try and show a correlation, but I honestly can't think of any reason why central bank balance sheets (assets?) would be correlated with movements in Bitcoin's (exchange rate?). The movement of Bitcoin is so much more volatile it doesn't fit within the graph. I would try plotting changes in an aggregate of stock indices against changes in Bitcoin. Regulatory thinking is that crypto should be considered a security, so that might be interesting.