Submitted by giteam t3_123o64p in dataisbeautiful

Comments

giteam OP t1_jdvfs7m wrote

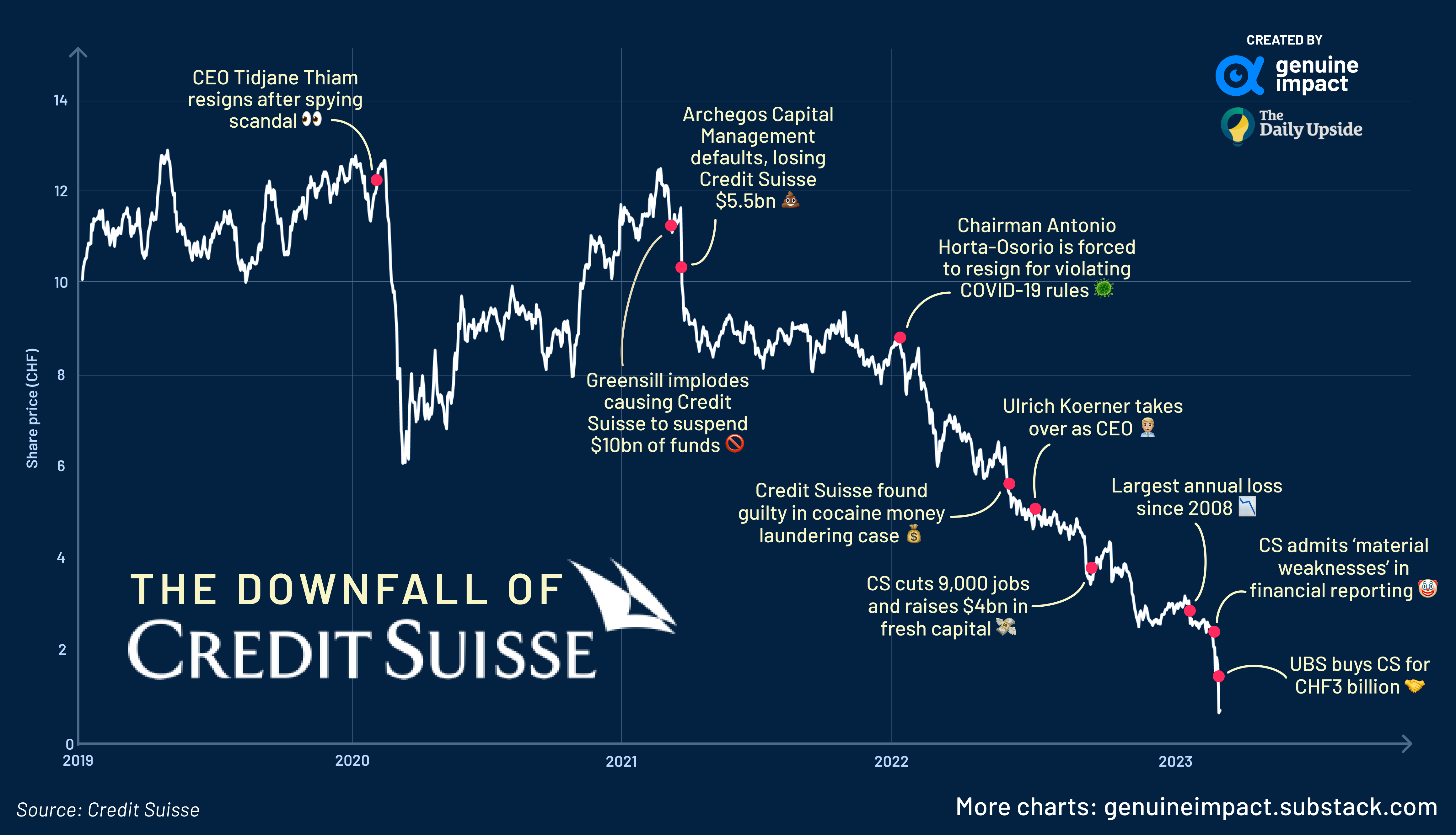

The Swiss bank's decline didn't start this year - since 2019 it has been rocked with scandals and bad investments that has brought the share price down by over 90%. Here are some of the biggest ones, culminating in UBS putting it out of its misery earlier this month.

Source: Bloomberg, Credit Suisse

kompootor t1_jdyxcru wrote

How do we find the actual source of your data? "Bloomberg" and "Credit Suisse" does not tell us anything of where to go to find out more, to check details on the dataset like its granularity, collection, and any adjustments, or to verify or cross-check your information.

Also, your newsletter link does not link to any actual issue -- it just links to your homepage.

Onimaster99 t1_jdw99iw wrote

Awesome graph! May I use this for a school presentation? I was literally searching for a graph like yours with no success and then boom… this pops up on my feed

giteam OP t1_jdwntpt wrote

Sure, with credit please :)

OhNoItsThatOne t1_jdwp4dj wrote

Should that credit be in english or.... suisse?

DamonFields t1_jdw5w11 wrote

Personally , I’d avoid any bank catering to money laundering and crony investing.

Go-Cowboys t1_jdxyslt wrote

So keep your money in a shoe box? Got it.

kingofwale t1_jdwzcjz wrote

Chairman forced to resign because of Covid rules??

What did he do? Accidentally removed his mask during a meeting?

nighthawk252 t1_jdxdd2m wrote

I looked it up. Wikipedia says there were 2.

The first was flying out of Switzerland after a 3-day stay at a time when the country had mandatory 10-day quarantine.

The second was attending Wimbledon at a time where UK Covid rules required him to be in quarantine.

I think the spiciest one though is some unspecified “transgressions in his personal life” that he admitted to in 2016 and sent an email apologizing for to 75,000 employees.

SomewhereAggressive8 t1_jdy4xw4 wrote

It sounds like they used COVID as a cover for what really was fireable.

Lejeune_Dirichelet t1_jdzrpzs wrote

An article appeared in the FT before his dismissal reporting "rumors" that the chairman was the only intelligent and competent person in the company, and that the CEO especially had no formal education in finance (which wasn't true). I think everybody saw this as a move by the chairman to create public pressure on the CEO and to play office politics. So the bank got rid of him.

Dipsi1010 t1_jdx45uw wrote

Haha who knows

wabashcanonball t1_jdy1wpq wrote

They were crooks and criminals is what went wrong—the Swiss banking industry is a sordid affair.

[deleted] t1_jdvsdwc wrote

[removed]

THED4NIEL t1_jdxe3g6 wrote

Reminds me of the case of HBSC

dontbyte t1_jdycxyq wrote

Where is the part with the CEO getting his bonus?

Kcnflman t1_jdylrv8 wrote

Those pesky retail traders

Old_Captain_9131 t1_jdym9e6 wrote

Excellent chart, thank you.

rashaniquah t1_je8fve4 wrote

Missed the Mozambique tuna bonds case and Evergrande

PornstarVirgin t1_jdxq0e7 wrote

NOW UBS will be worth 3x Swiss. Get ready for fireworks, this will get ugly.

teancumx t1_jdvog21 wrote

And that’s just the last 3 years…there’s a lot more in the story LOL