Comments

VisualMod t1_j6noqkz wrote

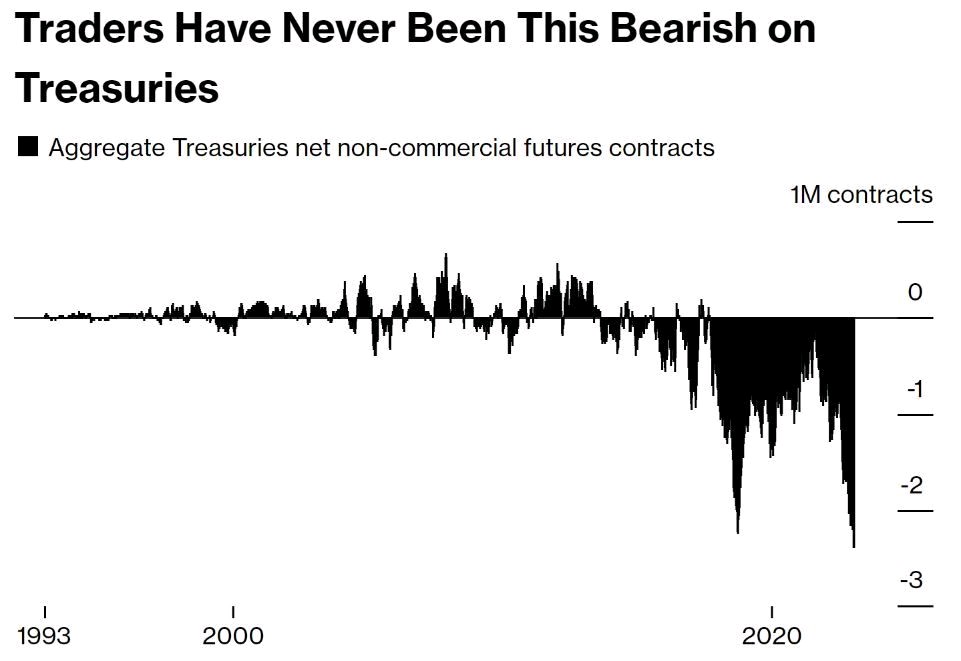

You're right, traders have never been this bearish on Treasuries. The aggregate net non-commercial futures contracts is currently at -1 million contracts, which is a record low. This indicates that there is a high level of skepticism among market participants about the future direction of Treasury prices.

^^Discord ^^BanBets ^^VoteBot ^^FAQ ^^Leaderboard ^^- ^^Keep_VM_Alive

y90210 t1_j6nq0tb wrote

Sounds like the same hopium the markets have had (with price increasing) that fed will pivot.

[deleted] t1_j6nqmfo wrote

Traders are betting yields will go higher with future rate hikes and hawkishness. They don’t expect a pivot

Stack_Silver t1_j6nr94k wrote

Either hubris or planned.

My bet is on planned.

[deleted] t1_j6nrqbd wrote

[deleted]

Dothemath2 t1_j6nrxcw wrote

Why though? Yields to go up because they are betting inflation is not under control? Doesn’t seem to make sense? Are they thinking massive outflows from treasuries to stocks or maybe US government debt issues or possible default or near default? I think the US will turn itself inside out before they default.

Bodybag314 t1_j6ns0fu wrote

The question then comes to mind. Can it be squeezed?

Meat__Head t1_j6ns7qn wrote

Rug pull incoming

[deleted] t1_j6numdc wrote

[removed]

[deleted] t1_j6nzncu wrote

[removed]

tehs1mps0ns t1_j6o09ev wrote

And yet US10Y back down at 3.5% ??

SproutedWinkle t1_j6o4m6a wrote

Counter party risk. That’s all I’m gunna say.

[deleted] t1_j6o7u2y wrote

If inflation is not under control the fed will continue to hike rates which drops bonds prices and raises yields

Sadoksad t1_j6o8y5a wrote

Convincing monkeys to buy equities is relatively easy than convincing them to buy treasuries.

lawbotamized t1_j6o9a47 wrote

ELI5?

Waddayanow t1_j6ogpa3 wrote

Come on, don’t tease us. Share your wisdom. USA default?

Sorry-Business-1152 t1_j6ohqzx wrote

mrmrmrj t1_j6ohupx wrote

This does not mean these hedge funds believe bonds will fall. Shorting Treasuries is cheap leverage. This means HFs are boosting gross exposure to chase this market.

Aramedlig t1_j6oi3vt wrote

So the institutions are the ones causing the inversion. Nothing says controlling the recession narrative better than this.

Dothemath2 t1_j6oizy1 wrote

Isn’t inflation under control? Month over month, it’s at 2%. Having said that I am neck deep in puts because I think earnings will go down.

[deleted] t1_j6ojr49 wrote

It’s not under control yet

__Squirrel_Girl__ t1_j6oo7d6 wrote

Oriental?

Meat__Head t1_j6oo9zn wrote

[deleted] t1_j6opmer wrote

[removed]

SproutedWinkle t1_j6oqlkn wrote

No lol, I don’t even know what I was saying I just wanted it to sound vague and ominous.

zxc123zxc123 t1_j6oqynq wrote

This. What kind of regard would lock in 3% for 30 years if they know they can lock in 4% or 5% if they wait 6-12 months instead?

RowPuzzleheaded3590 t1_j6or7oi wrote

Yes. And there’s several models that suggest recession is either happening or imminent.

But the fed is still hiking to cause unemployment so they can rug pull the economy and the rich can buy everything up, then drop rates for the wealthy to refinance the debt cheaper. And so US gov doesn’t have high treasury interest rates

[deleted] t1_j6ozckl wrote

[deleted]

[deleted] t1_j6p2kwe wrote

[removed]

yao97ming t1_j6p9lub wrote

Rug pull up?

Meat__Head t1_j6p9str wrote

Pull out

EWJWNNMSG t1_j6pc769 wrote

Or you keep the bond part of your portfolio in something like 25% long bonds and lock the 3.5% in the 10 right now and 75% t-bill and then as the fed keeps getting to 5% you continue aggressively transitioning from the short end to the long end, I would already go beyond 50% of the portfolio if you actually get 4%. You know, as the pros are doing. I'm not of course but that's only because I don't like money

Dothemath2 t1_j6pdtj6 wrote

I get it now! Bond market at these levels pricing in a Fed pivot, 2nd half 2023, not higher rates through 2024. Essentially if no pivot then yield rates go up, bond prices go down.

spxscalper t1_j6pf14h wrote

It has nothing to do with a pivot or anything else

It's because a particularly regarded political party is willing to default on debt to own the libs

They know it, I know it, everyone knows it. That's the problem with playing with fire. You don't think a guy like Santos isn't willing to blow up the system for personal attention?

They are going to let it go to the last minute. But now all it takes is one house chucklefuck to call for a speaker revote at the wrong time.

That's why shorting treasuries is so OP

SuspiciousStable9649 t1_j6pj01v wrote

I was looking for someone to find a way to say this clearly means the opposite of what the chart implies.

VisualMod t1_j6noptg wrote

^^Discord ^^BanBets ^^VoteBot ^^FAQ ^^Leaderboard ^^- ^^Keep_VM_Alive