Submitted by Accomplished_Day2991 t3_120h12y in jerseycity

Comments

Argenis_82 t1_jdh9e8d wrote

Of course. Jersey. House hunting out here is a nightmare

SweetheartAtHeart t1_jdi1r48 wrote

I agree it’s expensive but also, you couldn’t pay me to live in some parts of Alabama. Places where my partner (whose family is originally from down there) says is such a mess, it looks like a third world country. If I had to raise a family somewhere, I’d pay more to live somewhere where there aren’t more people on meth than people who are literate. You get what you pay for.

Argenis_82 t1_jdi264a wrote

Oh for sure. North Jersey also has some of the best schools for kids, which is one of the major reasons we are looking to stay in the area, but have you seen the shit holes that they're trying to sell for over $400k? Insane, really. And the feds just hiked up the rates. Smh. But I agree, no way in hell would I ever move down to Alabama. Hard pass.

bodhipooh t1_jdi4gb7 wrote

> If I had to raise a family somewhere, I’d pay more to live somewhere where there aren’t more people on meth than people who are literate. You get what you pay for.

Er... tons of places all over the US with much more reasonable taxes that are not shitholes filled with backward hicks or meth-heads. It's a weird take (but a common one among people in this region) to think it's either crazy taxes (for very shitty roads and infrastructure, government corruption, and overall HCOL - so not exactly getting all that much for what we pay) or living in real-life Ozark with meth, hillbillies, and whatever other stuff you are imagining.

SweetheartAtHeart t1_jdib8z3 wrote

I never said it’s one or the other. I was talking about Alabama versus jersey specifically because that is what’s in the charts. Context.

Edit: also, weird to say I’m imagining that parts of Alabama aren’t literally known for that and it’s documented that they have low literacy rates. They’re in bottom 10 if not bottom 7 if I remember correctly. This is easily verifiable lmao.

moobycow t1_jdjh7kv wrote

Literacy rate can be a weird stat, because if you are an a immigrant whose first language isn't English, you're likely considered illiterate.

Which may be a very different situation than someone who is just generally illiterate.

SweetheartAtHeart t1_jdjznoh wrote

This is a pretty good point. So there are different levels of literacy I’ve noticed. Sometimes, I’ve seen it referred to as just broadly unable to read and/or write a simple, short sentence while I’ve also seen it specifically clarified as below a specific grade level. There are also more official levels that can be read about more and you can read more about what each level is defined at. I remember coming across a pdf a while ago that broke up what each state’s literacy rate by each level was. Alabama was still ranked very low.

I imagine to get a rough estimate, you could say that you should try to account for immigrants by checking the proportion of illiterate people per population of both state and then also state minus immigrant population to see both. However, it doesn’t truly give us a very good idea because inaccurate immigrant count might lead to inaccuracies in known population and because I don’t know if it’s fair to says majority of all immigrants can’t read or write a simple sentence in English. There are lots of citizens who are immigrants and a fair amount of the citizenship test involves being able to read and study beforehand for example.

Edited a word.

xTheShrike t1_jdihyxn wrote

California has the lowest literacy rate fyi

SweetheartAtHeart t1_jdijgp0 wrote

Yep! Well aware. I didn’t say Alabama has the lowest literacy rate. I actually specifically stated they’re bottom 10 or bottom 7.

bodhipooh t1_jdi4ooh wrote

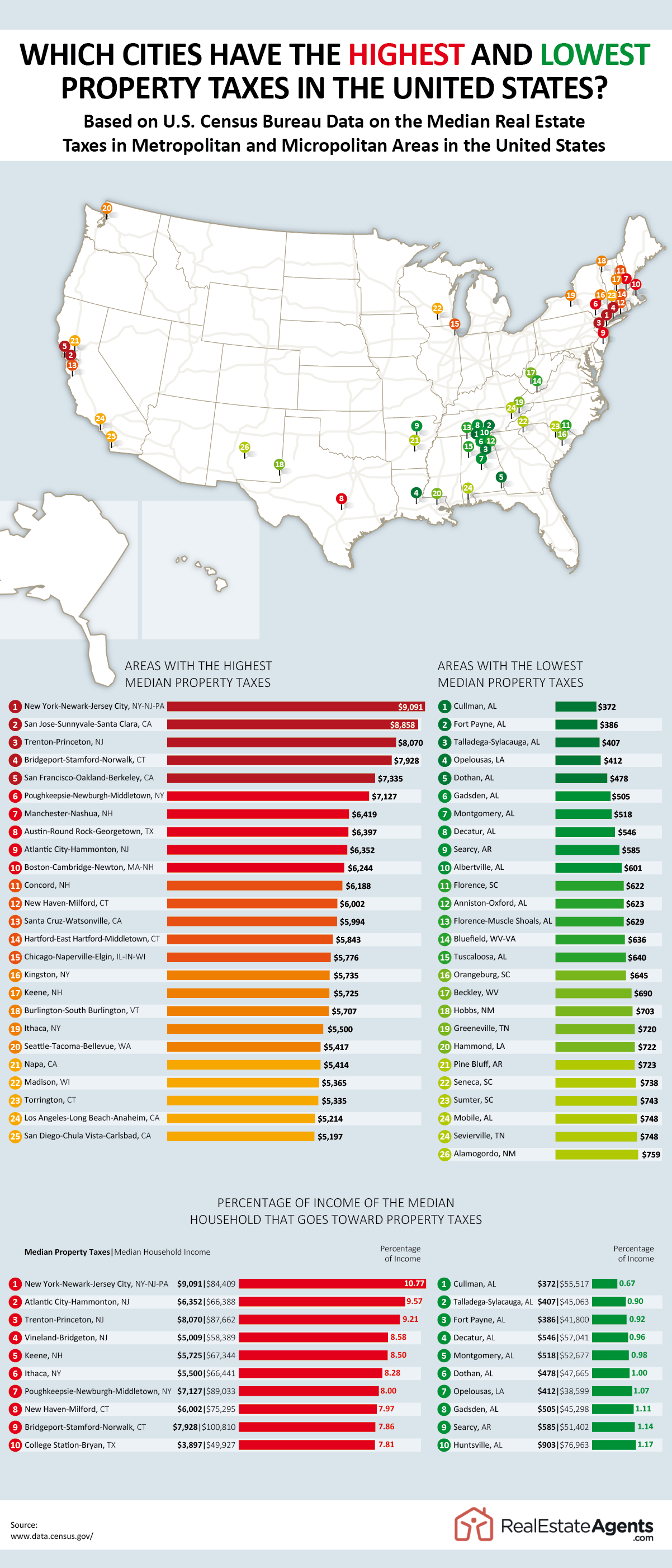

There is absolutely no way that #1 spot includes property taxes from NYC, as those are ridiculously low. That's probably just Newark-Jersey City properties being included.

ashlandbus t1_jdi9avb wrote

I bet they are - which is why it the median is only ~$9k.

A $725k home in NYC would probably be around $5k/yr for taxes, while a $725k home in much of Northern NJ would be closer to $15k-$20k.

bodhipooh t1_jdj7dyw wrote

Goog point. It should be even higher if it excludes NYC. I have friends in Brooklyn paying effective rates that's are closer to HALF of a percentage point.

GeorgeWBush2016 t1_jdioczk wrote

its for the entire nyc-newark-jersey city MSA

https://censusreporter.org/profiles/31000US35620-new-york-newark-jersey-city-ny-nj-pa-metro-area/

bodhipooh t1_jdj5zte wrote

In that case, an entirely useless statistic given the size and density. That area would encompass ~6% of the US population. I misread the infographic and thought they were adding the MSA solely as a location reference. Of course, your interpretation is much more likely to be the correct one.

Blecher_onthe_Hudson t1_jdiq29o wrote

You cannot compare just property taxes when comparing states. You need to look at 'total tax burden'. Some places use heavy sales and excise taxes instead of RE taxes, and it ends up very regressive. Note the difference between FL, always touted as low tax, & NJ is only 4%. But if you're wealthy, it goes up a lot because of no income tax.

moobycow t1_jdjhio5 wrote

Not even just total tax burden, total tax burden by income bracket varies greatly. Most income levels in CA have lower taxes than in Texas.

uieLouAy t1_jdmoy8a wrote

This. Lots of “tax burden” comparisons purposefully distort the rankings by only using the top marginal rate even though almost no one actually pays that.

New Jersey’s income tax is very progressive, so if you’re low- or middle-income you’re likely paying less than you would in many “low tax” states. It’s only folks who make over $1 million per year that pay the highest tax rate, and even then it’s only applied to every dollar made over $1 million.

pixel_of_moral_decay t1_jdmc62l wrote

Yup.

Most high income earners don’t even work in NJ.

And almost the entire states population is no more than an hour from an at least one other state, so sales tax can’t be much higher than an adjacent state.

People also forget our effective sales tax is actually lower than it’s listed since so many daily items like food are excluded. Not to mention UEZ’s are a short drive for many (and walk for those who live in JC).

If sales taxes were higher we’d all just cross state lines for any bigger purchases.

Property taxes are basically all NJ has to generate revenue.

That’s the economics of being a small landmass between 3 major metro areas (people forget some in south Jersey commute go Baltimore/Washington for work).

NY meanwhile can use sales tax and income tax much more heavily. Most of its population can’t easily travel to another state. Even in NYC most people aren’t capable of easily crossing over and taking goods back, lack of vehicles, or too much traffic. NJ to Queens is a trek for example, by car or transit. LI to NJ is a real terrible drive. So people won’t bother for the most part. NJ does get some Brooklyn/SI residents in our malls for things like back to school shopping and Ikea.

driftingwood2018 t1_jdi4of8 wrote

Heard the schools and healthcare are great in Alabama

well_damm t1_jdik0yp wrote

They keep it all in the family

GeorgeWBush2016 t1_jdio5uv wrote

This is MSA not city data.

Responsible-Salt-443 t1_jdknv5v wrote

There’s legitimately not even one place on the list of lowest property taxes I’d consider moving to.

djn24 t1_jdisl8v wrote

Not every area includes school taxes within their property taxes, so this is a little misleading.

mad_dog_94 t1_jdk3kxm wrote

I'm actually surprised that all the highest ones aren't in nj

LongjumpingArt9349 t1_jdnbi77 wrote

I hate my tax bill but realistically lots of NY metro suburbs are higher. Montclair, Ridgewood 20k, 30, 40k are normal.

JeromePowellAdmirer t1_jdhwg87 wrote

I'm ready to get down voted into oblivion - I ain't complaining. As a renter this is part of why McGinley Square area in an older building is cheaper than an equivalent older building in Boston. The land portion of a property tax is impossible to pass down to renters because the supply of land is fixed. Only the building portion gets passed down. I wonder what the median value of a property in this metro is? People who can afford to pay high taxes should be taxed to fund social services.

Blecher_onthe_Hudson t1_jdjulaj wrote

>The land portion of a property tax is impossible to pass down to renters because the supply of land is fixed. Only the building portion gets passed down.

I honestly have no idea what you're talking about. You can charge whatever the market will bear on unregulated housing. You can also structure it however you want. I found including free heat and laundry in the rent was hurting me in the search algorithms, so I broke it out into a fixed surcharge and lowered the rent. Separate water charges are common in some areas of the country. I don't see a legal reason a landlord can't simply break out the tenant portion of the tax and call it a separate charge if they like, and lower the 'rent' charge.

>I wonder what the median value of a property in this metro is?

You seem oddly helpless for an admirer of a numbers wonk.

https://www.redfin.com/graphs/image/regional-housing-market/home_prices/9168/6/All/0/1

JeromePowellAdmirer t1_jdk8ue4 wrote

You've never read the economics behind how a land value tax can't be passed down?

The supply of land is fixed. You can't pass the burden of a tax onto consumers if the supply is fixed.

This has nothing to do with whether you can charge market rates for the housing. Of course you can charge market rates for the housing. The market rate ain't going to include the land portion of the property tax. As you yourself say they're gonna have to decrease the rent if they want to keep charging the profit maximizing rate with the land value tax. This is not true of the building portion of the tax. Supply is not fixed there.

My question was quite clearly rhetorical.

Blecher_onthe_Hudson t1_jdkq6dn wrote

Huh. Fascinating. I guess the fact that my tenants pay 100% of the tax on all my properties is just an illusion.

[deleted] t1_jdl8r8d wrote

[deleted]

[deleted] t1_jdlappa wrote

[deleted]

Blecher_onthe_Hudson t1_jdnaqui wrote

1st, your whole theory is a fiction built upon a fiction. Almost one cares about the proportion of land to improvement in their tax. The tax is the tax. Further, the 'land proportion' is utter nonsense with zero basis in reality. Mine is $400k on a property that is identical to a vacant lot across the street with identical zoning that sold for $3m 5 years ago. Another property has it's land at $225k, while the identical lot next door is at $150k. Appraisals are voodoo at best, criminal at worst. Assessments are even worse.

2nd, you've made a whole lot of erroneous assumptions about me and my politics. I am never NIMBY, never complain about my taxes, and support urbanism at all times.

But you are correct on my Rent Control views, it is theft of private property, pure and simple. Instead of socializing the cost of housing the less fortunate like a civilized society, we have decided that rental property owners alone should bear the cost. Rent control is 2nd only to exclusive zoning in causing the housing shortage that drives up costs.

lastinglovehandles t1_jdh7w99 wrote