Submitted by hmiamid t3_xy7qym in dataisbeautiful

Comments

burn-it-all- t1_irfwiqh wrote

Wow. This is pretty awesome. In the 80s, rates got up to about 16%. Would be interesting to see the chart expanded to go that high.

hmiamid OP t1_irfxglg wrote

There you go up to 20%.

padizzledonk t1_irfzpwe wrote

Its actually less than that....WAY less depending on the State once you figure in property tax....My property taxes are about 6700 a year in NJ (which is pretty low believe it or not)

E- the more I've thought about it the more I think it doesn't matter because it's not the point of this chart, this is a really effective way to illustrate how much small but relatively major shifts in the interest rates matter....2%-5% doesn't seem like a lot of change but it has a massive effect on the prices of things long term

Awkward_Ostrich_4275 t1_irg15ee wrote

Edit: it’s been fixed

The 10% rate in your two graphs don’t match up. In your post, it’s 118k on Y and in this image it’s 160k.

padizzledonk t1_irg1a71 wrote

Don't forget to add back in to the monthly payment property taxes and insurance costs lol

squeevey t1_irg1qbs wrote

Those costs don't compound.

AidsNRice t1_irg2c1z wrote

Just never purchase a home 4Head, just that easy.

ApprehensiveSorbet76 t1_irg3rqv wrote

This is great! iso-affordability lines.Another interesting topic includes the change in amortization schedule. The higher the interest rate, the more front-loaded the interest payments become. So the rate of equity building of the borrower also slows down. This has a huge impact on people who do not stay in their homes for very long. It also makes it much easier for someone with a high interest mortgage to find themselves underwater in a market downturn.

hmiamid OP t1_irg3zy9 wrote

So sorry about that. I played a bit with the numbers and forgot to change. I put the original parameters. So yes. It goes down a lot more.

pookiedookie232 t1_irg40z1 wrote

Where does it intersect the x-axis?

hmiamid OP t1_irg4ih8 wrote

Good question, I don't think it ever does. As interest rate goes to infinity, you basically never pay back your capital, so you will never own any house. The curve tends towards y = 0.

hmiamid OP t1_irg51qj wrote

Interesting (no pun intended). I suppose we pay more downpayment at a high interest rate. Can we actually afford to save more in a high interest rate environment to prepare for a downpayment?

gh0stwriter88 t1_irg797d wrote

Even so it is one of the best and most educational things I've seen on this sub in awhile.

padizzledonk t1_irg8594 wrote

But it's part of the monthly cost of buying a home.

If you can afford a $1000 a month payment you really can't afford a $1000 a month mortage payment because your monthly payment is more Like 1600 a month figuring taxes and insurance(in my case....well, mine is more like 1200 but whatever)

I bring this up because it effects the total cost of the home you can actually afford

6700 is cheap in NJ, I have friends that pay 2x and 3x that....their tax bill alone is about a 1000-1500 a month

It just sets the entry bar lower

I get what you are trying to illustrate though- that the interest rate effects the overall cost far more than people realize....well, people who haven't lived under anything but the unsustainable and unrealistic interest rates of the last 20 or so years

squeevey t1_irg8reg wrote

Well, some were already saving regularly in preparation to purchase a house when housing prices skyrocketed. So it didn't seem prudent make rushed purchases, especially when you didn't have the EXTRA cash (on top of the down payment) to go above your proposed house price.

Some people are sitting on cash at the moment, waiting for the right time.

My point though is that with ANY compound interest chart, the chart only represents the LOAN you took, not necessarily the price of the house.

You may be able to afford 300,000 house when you chop $50K off the principle. It's all about how the various maths work for your specific situation.

Dismal_Flounder_8351 t1_irg984i wrote

Don’t forget that mortgage insurance. Less than 20% down payment and you end up paying for mortgage insurance.

thelandsman55 t1_irg9bf8 wrote

I feel like this is a little misleading because property taxes also reduce the value of homes all else being equal, so the costs are more likely to be passed on via reduced sale price than increased monthly payments.

nematocyster t1_irgb4e4 wrote

Yeah, but if you have a good credit score, it's pretty negligible. I pay $42/mo on a house about 240k. In 2012, i was paying about $143/mo on a $168k loan. The mortgage process has changed a lot since then (as did losing my dead weight ex's credit score)

padizzledonk t1_irgb6ib wrote

I put 60k down on my house and I still got PMI because my credit was less than stellar

5y and it just came off a few months ago over the summer

nematocyster t1_irgb72u wrote

Anecdotally, it's pretty much spot on for me.

ieatpoopooandsodoyou t1_irgb9zo wrote

That's neat. So we're all moving to ... North Korea? Or where are houses this cheap still?

dinobug77 t1_irgbmu7 wrote

Not everyone lives in the US.

But yes it will be less because of varying criteria including deposit requirements and for the US property tax

pookiedookie232 t1_irgbp70 wrote

Been a lot of years since I did real math so I probably won't go calculate this, but even if the function never reaches zero, anything under half a cent I think we could say rounds to zero and would put your max house price at $0.

starburst383 t1_irgc4r1 wrote

Yea, I feel like this is looking only at mortgage payment, but since property taxes are different everywhere it's not easily visualized. For example, I pay closer to 4800 I think.

Maybe a colored area behind the line showing the range of possible total payments?

ArkGuardian t1_irgcekd wrote

It is? There's a lot of things missing from American hs curriculum but compound interest is definitely on there

pivantun t1_irgd8h9 wrote

I think it's the other way around: When interest rates are low, house prices get inflated, and so downpayments go up.

ajour7 t1_irgdhzj wrote

If your house price is $0 then you cannot accrue interest so you cannot logically have a payment of $1000 (or any amount really)

ajour7 t1_irgdqto wrote

Btw, Great visualization OP!! This is something very useful for anyone who has bought or has aspirations for buying a home.

pookiedookie232 t1_irge9pi wrote

Okay, so I ended up using excel, and found that around 240,480,000% interest the max loan is .499 cents, so essentially zero, lol. You pay $1,000 per month for 30 years on essentially nothing!

pookiedookie232 t1_irgehmj wrote

VA loans have no PMI, even at 100% borrowed

pivantun t1_irgeift wrote

That doesn't sound right for a standard 30-year-fixed-rate loan. They are designed to fully pay-off the principal at 30 years.

Doctor_Kat t1_irgemyj wrote

Wow. At 16% your paying $360k over the life of the loan for an $80k house.

pookiedookie232 t1_irgevm1 wrote

Yep, once I looked at the formula I was like, "Doh!" Can never actually be zero. But it could be less than half a cent, which is essentially zero due to rounding in financial systems. I calculated that 240,480,000% interest will net a $1,000 payment for 360 months on a .499 cent loan.

ChetThundercott t1_irgeyk2 wrote

A $1000 a month mortgage payment is pretty low I would say. So perhaps consider this chart is made for a first home buyer with that sort of budget.

MomTRex t1_irgg46z wrote

We bought in 2003. I believe that the rate now is still lower than when we bought. People screaming left right and center about the current rates don't understand that historically the rates were sooo low recently.

When I was in college the interest rates were in the mid to high teens.

That said, it all sucks right now and I've told my college age son to stay in school for at least another year and a half. : (

Edited to say that I'm not a boomer (Gen Xer) and wasn't able to purchase a

house until I was comparatively old

hmiamid OP t1_irgglix wrote

Yes also feel free to multiply by the amount you want. If you're thinking 2000/month just double the y axis. Relation between house price and monthly payment is proportional.

hmiamid OP t1_irgh9w7 wrote

That's why the house prices in the 70-80s (around that time) were so low. We were actually better off a few years ago than in the past if we're looking at total mortgage payments in terms of years of median income.

[deleted] t1_irghd9u wrote

[deleted]

Emfx t1_irghn5m wrote

Talked to my sister who graduated a few years ago, and she said she never had classes on it.

I did some Googling, it appears only 14 states require some type of personal finance course to graduate:

- Alabama — High school students must take a one-year career preparedness course that includes personal finance lessons.

- Florida — High school students are required to take a personal finance class to graduate.

- Georgia — High school students are required to take a financial literacy class in their 11th or 12th year to graduate.

- Iowa — All school districts require students to take at least one half-year personal financial literacy course beginning in 2022-23.

- Michigan — High school students must take a personal finance course before graduation to receive a diploma.

- Mississippi — Beginning in 2022, Mississippi will require students to take a college and career readiness course before graduation. Financial literacy is one of the units for students in that course.

- Missouri — Students must earn one-half credit in the area of personal finance to graduate.

- Nebraska — Beginning with the 2023-24 school year, students must take at least five hours of personal finance or financial literacy classes to graduate high school.

- North Carolina — Students are required to pass a personal finance class to graduate.

- Ohio — Students entering the ninth grade on or after July 1, 2022, must earn one-half credit of financial literacy to graduate.

- Rhode Island — The state is developing a plan to create statewide standards for financial literacy in public schools.

- Tennessee — High school students must take a half-year course in personal finance to graduate.

- Utah — All high school students must take a half-year course on personal finance topics as well as an end-of-course assessment administered by the state.

- Virginia — High school students must take one-year economics and personal finance course as a graduation requirement.

Sheamus_1852 t1_irghtd0 wrote

And the average US home price was 68k at the interest peak in 1981. It’s 348k today.

hmiamid OP t1_irghthn wrote

It's not a logarithm. Formula is (1-q^-N )/(q^(1/12)-1) where q is 1+r, r is the interest rate and N is the mortgage term in years.

padizzledonk t1_irgic5q wrote

The more I thought about it the more I realized it doesn't really matter tbh because it's not really the point of the graph- which is to simply illustrate how much the interest rates matter to affordability....and it drives that point home pretty effectively

hmiamid OP t1_irgifq7 wrote

Yep. Warren Buffet said interest rate is like gravity. It brings price to a more "down to earth" value. Low interest rates makes prices "float" too high.

rainpizza t1_irgihes wrote

What's the formula behind this graph?

Asking because I am curious to see if I can tweak it for my situation.

[deleted] t1_irgii9g wrote

[deleted]

hmiamid OP t1_irgj20r wrote

Sure. Formula is (1-q^-N )/(q^(1/12)-1) where q is 1+r, r is the interest rate and N is the mortgage term in years. Make sure to put r without a percentage. So f.ex. for 5%, r = 0.05 and therefore q = 1.05. The 1/12 is because we pay every month.

hmiamid OP t1_irgjtfu wrote

Sorry, I am not familiar with property taxes. I'm not in the US. But it looks like it's variable in time and place. And it's not compounded and wouldn't change with interest rate (at least not directly).

coke_and_coffee t1_irgkj1c wrote

Just have rich parents, my dude. It’s that easy

Emfx t1_irgkpb3 wrote

My sister-in-law was in the market for a house this month, they were looking at some in the $650,000 price range. Everything seemed to be going amazing, and then they randomly wanted around $135,000 down, because they said their $20k current debt is a "major risk". They check every other single box... they're essentially the perfect borrowers. It's crazy out there right now the hoops some places are having people jump through.

I believe they're now working with another mortgage officer who is giving them run-around.

hmiamid OP t1_irgksfl wrote

In terms of abstract maths, it's called a limit towards infinity. We can never realistically create an infinite interest rate, but if we do, we pay 1000/month to own nothing after 30 years (or any amount of time for that matter). The principal is simply 0. I mean the original question I think was more of a mathematical curiosity than anything realistic.

hmiamid OP t1_irgl5ov wrote

Or save money by stopping eating avocado toasts.

pivantun t1_irglrby wrote

Oh, I think I understand what you're saying. That as the interest rate goes up and you limit the monthly payment to $1000 then you'll have a situation where the loan would not get paid-off. I don't think that's realistic, since the home would be repossessed if you didn't make the correct payment.

My point is that a standard 30-year loan could, in theory, have any interest rate, but it would still be paid off in 30 years. You just may have a payment that's more than $1000/month.

vanman33 t1_irgm9f2 wrote

This always astounds me. I’m in Colorado and while values have exploded at least our property tax is sane. How the hell can anyone justify 5k+ per year and houses worth less than 1MM? My house is probably worth 500k and I pay $1100/yr.

[deleted] t1_irgmglb wrote

ArkGuardian t1_irgn18k wrote

Compound interest is typically taught as part of the exponential functions unit in Algebra 2. A separate financial literacy class is needed but not a requirement to learn about interest rates.

857477459 t1_irgo4jp wrote

This is why all those posts about how much less houses used to cost need to be taken with a grain of salt. House prices are so high in large part because interest rates were so low for so long.

857477459 t1_irgopei wrote

Graphs like this can be extremely deceptive. Long term interest rates are a function of inflation expectations. So the real value of your payments is expected to re reasonable faster when rates are higher. In the long run high inflation times are likely to be the best times to buy a house.. but your early payments will definitely sting.

[deleted] t1_irgqo1t wrote

[deleted]

Honest-Persimmon2162 t1_irhgxph wrote

Nice info, very informative. I’ve got a few formatting suggestions: you’ve got the x-axis labeled as percent in the title, then also show percent at each label, I’d ditch the percent in the labels and use a major unit of one for labels. The y-axis, I’d go with 1000’s of currency units: 6-digit labels and data labels are overkill and the rounding wouldn’t lose much fidelity.

PryomancerMTGA t1_irhi2ms wrote

But the house appreciated as well. My parents got a $25k house in the early '70s, it worth $400k+ now.

girhen t1_irhjhtu wrote

For the record, 68k in 1981 is about $222k today, and $1,000 was about $3,260.

Not saying that wiped it out - housing prices are still a bit over 50% more expensive today after inflation adjustment. Just putting context behind numbers.

Negs01 t1_irhn5mt wrote

Indeed, construction costs have likely increased for various reasons, but I would bet that low interest rates along with other subsidies (lowering FHA standards for example) have been the primary drivers of increased home costs.

​

I'm curious how much the price has increased in terms of square feet though. Average home price has gone up, but so has average home size.

​

This is a little dated, but assuming the trend did not reverse, median home sizes have increased at least 66% since the early 1970s.

TotalZillowAddict t1_irhnd8u wrote

“Can be deceptive”

It’s a mathematical function, not financial advice.

beh5036 t1_irhomcb wrote

Just switch companies. My auto insurance did that. So I switched and it’s been 4 years of constant rates or rate decreases.

hmiamid OP t1_irhuiwy wrote

Which happened in 2008 with adjustable rate mortgages. In the UK, practically every mortgage is variable rate.

Meem_Masheen t1_irhv2r2 wrote

My property tax is like 800/year in Indiana

Sheamus_1852 t1_iri2zrj wrote

Thank you for doing the math, I was being lazy.

Average salary in 1981 was 47,720, 2022 it’s 53,490. 47,720 adjusted for inflation to 2022 would be 155,481. People in 1981 had almost 3x the buying power of people in 2022.

Edit - average salary in 1981 was 10,495. 47,720 is already adjusted for inflation.

There is also the exponential growth law. The greater the number, the bigger the impact of APR changes. A house at 68k’s annual interest. 7.5% = 5100 10% = 6800 Difference of 1700

A house at 348k: 7.5% = 26100 10% = 34800 Difference of 8700

This is why interest is a larger impact now. When houses are 68k going up 2.5% is not a massive impact. That’s $142 on a monthly payment. You can penny pinch to make that happen. At 348k a 2.5% hike is $725 monthly. There’s not many who can penny pinch to get around that. These are in year dollar values because that is how the impact would be felt.

Housing prices have far outpaced wages leaving minor interest rate increases to cause massive swings in profitability. There is always the chance to refinance but we’ve all gotta wait on that.

StationOost t1_iri3zyy wrote

Sartres_Roommate t1_iri4lnj wrote

Yeah, but that is 50, not 30, years

ac9116 t1_iri4pqb wrote

The lower interest rates also had an impact on said appreciation

Sartres_Roommate t1_iri4tjq wrote

That is a gross oversimplification at best....and that is being generous.

julietOscarEch0 t1_iri5wkv wrote

Bit daft as ignores the effect of inflation on nominal House prices and wages. Higher mortgage rates likely correlate with higher inflation. Which in turn means you'll be able to afford more than 1000 repayment later in the life of the mortgage and that the terminal nominal value of the house will be higher.

Obviously higher rates indeed should mean lower house prices, but this is quite an oversimplification.

quintk t1_iri5xuv wrote

Property tax in the US is paid to the town or city.

Property tax is paid once or twice a year and is a percentage of the value of the home. But that percentage changes based on the needs of the town. If everyone’s houses are suddenly worth 20% more, the tax rate percentage will probably decrease (because the town budget hasn’t increased by 20%) and the actual tax in dollars won’t change that much. Different towns will have different tax rates depending on their budgets, the property values, and whether they have other income (for example commercial taxes).

Every US state is run differently. In some states more is done by the state, or they provide more assistance to the towns. These places may have lower property taxes but there may be state income or sales taxes.

Some states provide more services to their residents than others, and as with countries, providing more services, or having more people who need them, means more tax overall. So you can have high property taxes but low or no income or sales taxes, or high income and sales taxes but low property taxes, or all three may be high!

Jitler86 t1_iri8tvm wrote

Geesh, someone forgot their bootstraps apparently.

TiredPistachio t1_iri9k01 wrote

You salary info at the top is wrong. Those numbers are already inflation adjusted

hmiamid OP t1_iria0vi wrote

If you go and apply for a mortgage on a new house, they look at your current income. Maybe you'll be able to pay more later but it's not the point here. If rates rise from 1% to 7%, and you got the OK from the broker for a 311k mortgage a few months ago, now you can only be accepted for an 150k ish one.

Tak_Galaman t1_iria871 wrote

Ooo yeah I was trying to figure out why this was so far off from my reality. It's because this chart is about the mortgage you can afford not the total house price.

julietOscarEch0 t1_irialf7 wrote

Sure, your max remortgage loan will drop but you've also locked in a fantastic rate so you don't want to remortgage in that scenario.

So sorry what is the point here? That new buyers can't get a big enough mortgage? That's not really a new thing with high rates though.

hmiamid OP t1_irib5n2 wrote

It's an arbitrary unit. Multiply by what you like. 2000/month means you multiply the y axis by 2.

Sheamus_1852 t1_irib6bd wrote

Thanks for the heads up. I edited the comment.

hmiamid OP t1_iribryz wrote

The point is how fast the curve drops from low mortgage rates to high ones. This in turn drives the house prices down because of lower purchasing power. And that's for everyone. It won't be half though because every buyer is not a new buyer. Remortgaging is in some countries (like the UK) a necessity too as they are mostly 5 yr fixed then go to SVR. Of course if you lock a 30yr low rate, you don't care about all this. But it's not the case of everyone and some countries will be more affected than others.

julietOscarEch0 t1_irictdc wrote

But what do you think your numbers represent? US mortgage rates already went from 3 to 6/7 and we're not seeing anything like the drop you show. I contend that's because your analysis is naive with respect to inflation.

Regarding the UK market sure, but then the impact on 30 years fixed repayments is irrelevant because you can't fix for 30 years. Again, the wage/house price picture in 5 years (actually less since many people fix for 2) cannot be ignored.

cepegma t1_irie1ib wrote

What's certain is that the interest will stay high at least during the 2 years to come. Very likely they will continue to go up.

Neat-Programmer2722 t1_irigklm wrote

In Addition to the other posters this excludes a lot of other factors for house ownership that would be helpful for people to put into context such as PMI, home owners insurance, and annual taxes all divided over 12 months to get a monthly rate. With repair costs on top of that you will quickly determine how much house you can afford is not generally not as much as a bank will approve you for.

Neat-Programmer2722 t1_irigxzi wrote

In my area houses and affordable housing was not being built at a proper rate due to a lot of factors but yes labor material costs were part of that.

Now the prices are so high there is a housing build rush however there is an extreme shortage of labor and extreme shortage of housing. Supply and demand.

hmiamid OP t1_irihdpf wrote

- you don't really expect the market to crash the day after the interest rates rise. Its a slow progress.

- how do you think UK banks calculate people's affordability then?

Bells_Ringing t1_iriie2p wrote

The lender wanted 20% down? That doesn't seem outrageous if they are the perfect borrower. In a rate change environment like this, to get the best available rates, the banks need the best assurances of repayment and Loan to value.

They likely could have out less down but their rate would have been higher if the banks are assessing an increased risk right now.

TheOtherSomeOtherGuy t1_irijah1 wrote

You really need to use commas in your number formatting

izzie90 t1_irijcdh wrote

My first house (townhouse) out of college in 1984 was $62k at 14.5% mortgage in capital district NY. We sold it 5 yrs later for 90k. That buyer sold it 20 yrs later in 2019 for $194k. Zillow has it estimated now at $258k

Hodorous t1_irikhu3 wrote

In 70's/80's wages increased at much higher rate also(about 6% in US and over 10% in some European countries).

julietOscarEch0 t1_iril2ei wrote

UK bank affordability test already bake in a component of resilience to rate rises and the binding constraint for most people is an income multiple limit or raising a deposit. As such affordability has a lower dependence on rates than you might expect(and certainly nothing like your model). Probably the biggest impact so far is banks starting to withdraw 95% LTV deals.

So when do you expect the 30% drop in prices? I assume you have sold all property and found a way to short real estate since you seem to think the outcome is so certain?

highline9 t1_irip7fy wrote

Why downvoted? Also, for the three folks I just asked, me included, this doesn’t hold true. A $250K house at 3% is no where near $1k a month…more like 1650

zehhet t1_iriq6pr wrote

Is that your total payment each month, including payment to taxes/insurance into the escrow account? This is only talking about the cost of the debt, not the total cost of ownership, which is always more.

asterios_polyp t1_iriqaca wrote

I attribute my relative financial health to accidentally perfectly timing the market when I sold/bought. It is frustrating that the timing of buying a house can have such a dramatic affect on your wealth.

IronGravyBoat t1_iris8w5 wrote

I like to think about it like this, if the initial offer was 4% and it's lowered to 3% that's 25% off the original rate. That's like goint from 20% to 15%

sevargmas t1_irisigm wrote

Is this adjusted for inflation?

highline9 t1_iritrso wrote

No, just straight mortgage…I initially thought of that (total payment…taxes, HOA, pmi, escrow) but remembered to just think about straight mortgage when trying to make the chart work for me…total payment is almost 2500 (very high HOA, live on the water/gulf, HIGH insurance)…quite honestly, if there was a person to have it not work/be normal, that’d be me, lol.

The_Slad t1_irivqz8 wrote

This is just straight mortgage right? No insurance/taxes or other escrow stuff included? Also is this assuming a down-payment at all?

I pay total around 1k per month for 30 year loan on 150k mortgage with 10% down and ~4% interest.

Without including all these other factors accounted for the data shown doest really match what people could actually afford.

DanitesHell t1_iriwxs7 wrote

Not very beautiful tbh, commas would help a lot

SnowTinHat t1_irizc9f wrote

You should do one for how much house you can sell at different interest rates (\s). When you have bought a house and not died already, you might want or need to sell it. It’s useful to understand those dynamics.

ApprehensiveSorbet76 t1_irj289k wrote

That is also true, but I was referring to, for a given monthly payment, the ratio of that payment that goes to interest vs principle. As a fraction, the lower the interest rate, the more of every payment goes to principle. For the very high 10% and above rates, principle might only be 20 bucks a month vs 980 paid to interest. For the very low interest rates, nearly 50% might go to principle and 50% to interest. For all cases, payment 360, the last one, will be mostly principle. So maybe it’s $980 principle and $20 interest.

This dynamic significantly affects loans that are not kept to maturity.

PryomancerMTGA t1_irjdhoc wrote

Wow really, I guess it's totally meaningless then.

Sartres_Roommate t1_irkd0qk wrote

Wow, you really jumped right to the hyperbolic strawman. But let's dig on that.

A. My parents bought a house in '83 for roughly $160k and made massive capital improvements on it over 30 years and then sold it in 2015 for about $250k. The value doesn't always skyrocket, a large part of that has to with specific economic growth in the location, location, location

B. I bought a place in '99 for $120k and it sold two years ago for $290k (we sold it 10 years ago)...the location became a booming area of growth.

C. The main point is those extra 20 years your parents had that house is likely the majority of the appreciation in value. Housing overall has been on an unsustainable rocket ride for the last 20 years, even WITH the 2008 crash, and the last 2 years have been even more batshit insane.

And lastly the specifics of early to mid 70s was a market low AND right as the rampant inflation of the late 70s/early 80s kicked in. There is nothing average about your parents particular housing appreciations experience. Historically they are outliers.

And that is a a very important thing to understand. The 2008 crash was partially driven by the fallacy that home ownership was like a guaranteed profit generating machine; buy more than you can afford because if payments becomes an issue you can just sell in 2 years for 160% of what you paid for it.

randomthad69 t1_irlxtg5 wrote

My parents bought a house for100k it sold for 720 25 years later

lolubuntu t1_irlypt8 wrote

https://www.inflationtool.com/us-dollar/1970-to-present-value

25 x 7.7 = 192.5

So overall while the nominal price is up ~16x, the 'real' price is only ~2x higher after factoring in inflation.

Yeah, 400 is worth more than 200, but it's not night/day different. You would likely end up in the same (or better) living in a small place and tossing A LOT of money into stocks. The DJIA was at ~750 in 1970. It's presently at ~30,000, which is 40x higher.

PryomancerMTGA t1_irm0ewh wrote

First a technicality, home ownership is a leveraged investment that also provides several tax benefits that offset Dow index investments advantages. So it wouldn't be calculated a a 2x roi over the time period and was likely cash positive relative to renting before they sold it.

Second and most importantly, would you really advise a couple parents to rent rather than own? Home ownership and paying a mortgage has significant advantages over renting.

lolubuntu t1_irm3zb7 wrote

>First a technicality, home ownership is a leveraged investment

You can leverage stocks as well, though not as aggressively. Though calls are a thing.

>that also provides several tax benefits that offset Dow index investments advantages. So it wouldn't be calculated a a 2x roi over the time period and was likely cash positive relative to renting before they sold it.

Depends on income.

If you're in a lower income tax bracket (under $160,000) it makes less sense because the tax benefits are lower.

If you're high income and in a state like California, it makes more sense as your marginal tax rate is around 50%.

BUT this assumes that owning a house has 0 impact on income. There are studies showing that when controlling for education and a few other factors, home ownership reduces income. People are less likely to job hop. "look I saved $100k on rent the last 10 years" sounds kind of stupid if you missed out on $500k in income AND you opted for 2-4x the square footage you otherwise would have... and you spent half your free time mowing, cleaning gutters, painting, etc.

Also, taxes ARE a thing. Using a 1.5% tax rate each year, in the short to mid-run you can end up paying almost as much on property tax as you would on rent overall in A LOT of places.

This also applies on the back end if you ever try to realize appreciation as well, though there are SOME exceptions to that if you lived in a residence 2/5 years.

PryomancerMTGA t1_irm4vdc wrote

That's a really interesting point on home ownership having a negative impact on income. That's a really good point.

I wasn't aware of anywhere that had property taxes equivalent to rent. I'll have to look into that.

As you have pointed out home ownership decisions can get complicated. It was the right decision for them, but I'm the current market with avg home prices in the $500 k range and mortgage rates like they are maybe not buying makes sense (Dow scares me now too).

lolubuntu t1_irm7r8v wrote

Don't get me wrong, I wouldn't mind going back in time to 2020 and tossing some cash down and buying a house. Timing the market is hard though.

Home ownership as a FORCED savings plan has some benefits though - namely that it forces undisciplined people to toss $$$ into something other than new cars and booze.

It's just that all BS considered it's often a wash vs just putting money in an index fund.

And you would likely end up ahead, living in a tiny shoebox apartment and chasing $$$. 5 years at a FAANG banking (net of taxes) $100-200k a year is enough to basically buy a house, cash.

Home ownership is kind of fetishized at this point. It feels almost like the same level of circle jerk as it was back in 2006... though I could be off.

I'll probably buy a house when I'm sick of the rat race and decide to semi-retire (aka have enough $$$ to retire outright but want more spending $$$, something to do and the prestige of being a "semi-retired 30-something year old college professor" over just being unemployed).

No_Breakfast1204 t1_irow1tc wrote

Exactly! When they say "asset bubble" fueled by low interest rates, that's a classic example.

No_Breakfast1204 t1_irow6m7 wrote

You sound like a real estate agent.

burn-it-all- t1_irrdlzm wrote

Awesome!! This is a great chart.

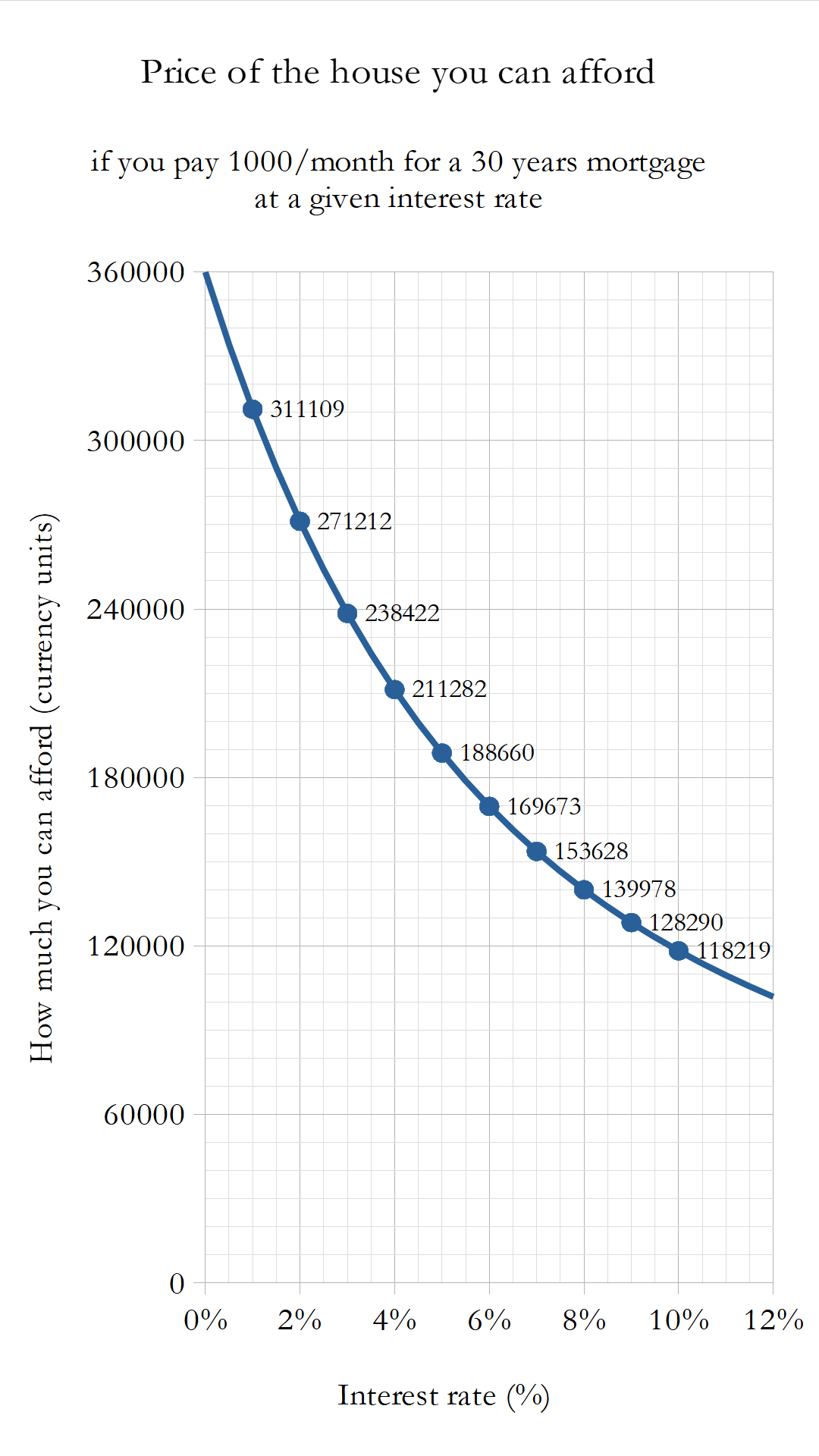

hmiamid OP t1_irfso80 wrote

Data source is only maths. Compound interest formula. Tool used is LibreOffice Calc.

This data shows what house price you can afford for a given interest rate supposing you pay 1000/month for 30 years on the mortgage.

So the idea here is, people on average when they start a mortgage, always pay a given amount per month to their mortgage (usually a third of their income f.ex.). And this is the same whether the interest rate is low or high.

For the demand to meet the offer (1000/month example), the price of houses fall. I wouldn't generally say that drastically like in this graph but this is the trend.

From 1% to 7%, the price is practically halved.

Edit: 7% instead of 6%.

Edit: a few pointed out that 1000/month isn't really how much most people pay. It is an arbitrary unit. If you are considering 2000/month, just double the y axis. Relation between house price and monthly payment is proportional.